A Challenging Environment for Active Management

August 31, 2014

This market environment has been particularly challenging for active managers. So far in 2014, according to Morningstar, actively managed mutual funds are trailing market benchmarks more than any other full year since 2011. More than 74% of actively managed mutual funds that invest in large cap stocks are lagging the S&P 500 – the second worst performance record going back to 2004. It’s no wonder pundits are declaring the end of active management. Why has this been the case? The Federal Reserve (“Fed”) has manipulated asset prices through Quantitative Easing (“QE”), keeping interest rates historically low and increasing investors’ tolerance for risk by lowering risk free rates well below what we would deem to be “normal.” This policy has led to investors gravitating towards fewer factors that best capitalize on this “free pass” on risk. This has ultimately created a very narrow market (difference between the best and worst managers at historic lows). As a result, indices on which passive strategies are based look fully valued. We will outline in the following text that not only is this the best environment for active management, but that moving towards passive now will increase investors’ risk of losing capital during the inevitable return towards fundamentals as the Fed winds down QE and normalizes monetary policy.

We believe strongly that active managers can take advantage of market inefficiencies through equity mis-pricing to generate alpha and to decrease risk relative to a passive approach. This isn’t just an academic stance, rather it is fundamental to our discipline and has been proven to be effective and consistent over market cycles. The case for active versus passive management is a cyclical debate. The cyclicality seems to be contingent on stock correlations and sector dispersion. When the market favors a few factors and moves in tandem, it is more difficult for active managers to outperform, and investors lose confidence. When investors put more weight on fundamentals, and stock specific factors drive prices, active managers will again outperform.

The Impact of Quantitative Easing

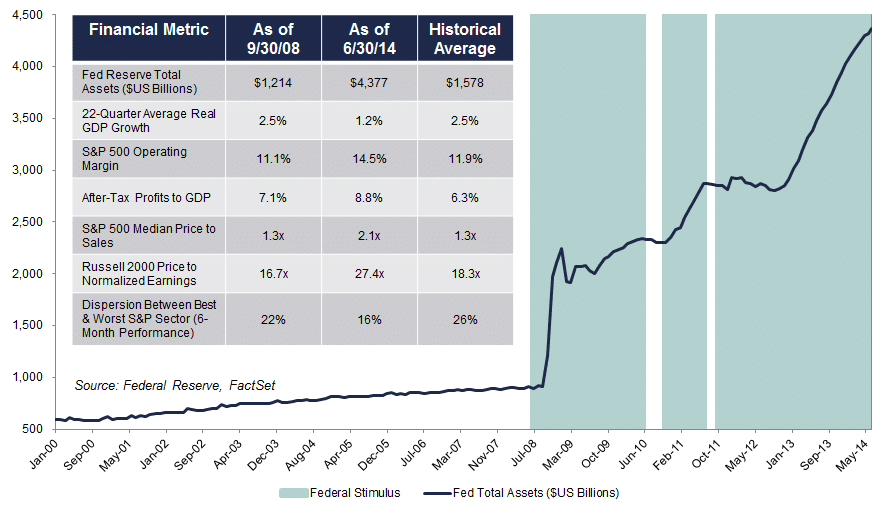

As the chart below clearly shows, the Fed’s balance sheet has increased dramatically, depressing yields and pushing investors towards risk in order to generate returns consistent with historical expectations. TINA (“there is no alternative”) has become the rally call for bullish investors. Given the moderate growth environment, companies have cut costs, increased debt (with lower interest costs), neglected capital spending and bought back shares to maintain peak margin levels. Investors have extrapolated these profits into the future and stretched valuations beyond any normal earnings power. Stock specific factors haven’t been material, as the historic low dispersion (the difference between the best and worst) in S&P 500 sector performance shows. Given the 93% correlation with the S&P 500 performance and the Fed’s balance sheet, we can conclude that the market returns were largely manufactured by monetary policy. This has been extraordinarily beneficial for smaller market cap companies that have benefited from this flight towards risk. Profits and valuations don’t stay at these levels indefinitely, as such, it is the responsibility of active managers to avoid these pockets of speculation, which may mean underperforming in the short run.

Factor Extremes

The current market environment has been very thematic and less fundamentally focused. We can see this by looking at correlations of individual stocks in the S&P 500 to the S&P 500. While correlations have come down somewhat over the past couple of years, they are still above historical norms. As correlations approach one (meaning that all stocks trade in the same direction), it is difficult for stock selection to be rewarded. There is a narrow path towards out-performance given that many stocks are moving on data outside of their idiosyncratic attributes. In other words, good fundamental companies are rewarded less than the group as a whole. This is a great environment for unmanaged indices given that benchmarks are trend followers, constructed with the current “favored” stocks and, as a result, become highly concentrated in those factors. Indices are not portfolios designed to control risk by allocating capital from overvalued sectors towards undervalued sectors. As a matter of fact, an index does just the opposite by adding weight to sectors and stocks that are doing well. This can result in a much greater exposure than one would logically want in any one area. So in order to keep up, managers are enticed to look like the benchmark. Active risk, or looking different than the benchmark, will be a greater headwind to relative performance regardless of the investment rationale. In this type of environment, managers tend to focus on relative risk versus absolute risk. Managers that are concerned with losing assets focus on relative risk (not looking like the benchmark) and those that focus on building wealth over the long term and downside protection focus on absolute risk.

Strategies that have done well in this environment have been positively correlated with growth at any price (little or no valuation discipline), beta, and momentum. This makes sense, given the strong performance of lower quality, smaller cap companies. Conversely, strategies that have underperformed have been more correlated with valuation, profitability, and earnings quality. Most active managers have a more rational, or balanced approach. Active management’s role is to allocate client capital away from overvalued areas, towards undervalued segments with promising growth potential. The indices benefit from the extremes in the market – namely a small cap bias, which has been the best way to play growth, beta, and momentum – factors that are driving overall returns. When these factors become out of favor, it will take a while for the indices to re-allocate towards market fundamentals. In the meantime, investors are left with a lot of potential volatility.

Narrow Market Environment

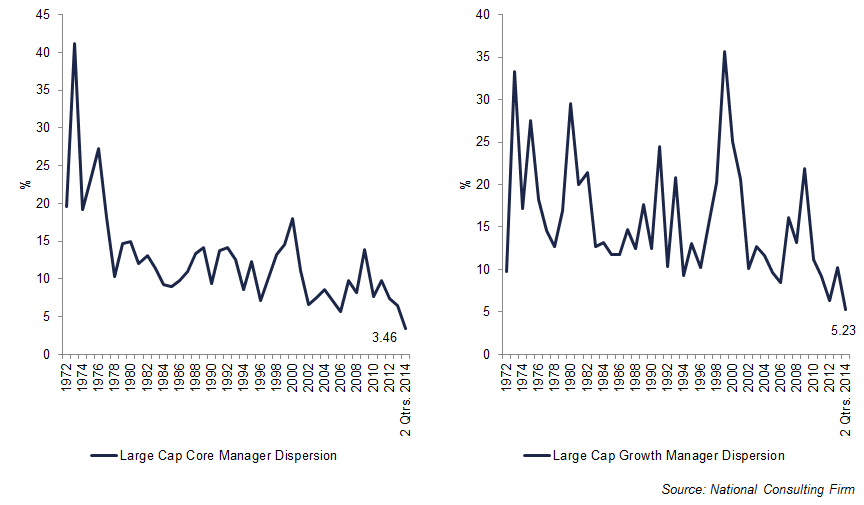

Breadth allows active managers to leverage their stock picking disciplines. If there is no breadth in the market, it is very difficult for active managers to add value with stock selection. Large flows into passive strategies to capitalize on these narrow themes, including ETFs, are the likely culprits of this low dispersion environment. The large cap space has been particularly subject to these thematic biases. The charts below measure the difference in calendar-year returns of the 10th percentile manager and the 90th percentile manager in the large cap core and large cap growth universes, respectively (source: National Consulting Firm). The last data point, from June 30, 2014, marks the lowest dispersion in the history of these respective universes. The return difference of 3.46% and 5.23% reflects the gravitation towards similar factors. This is a point where investors should become extremely cautious and where active managers should become more opportunistic.

Investors moving towards similar themes are more likely to experience large losses once those extremes in the market revert towards normalcy. Relative risk might be low, but the absolute risk (losing capital) could be substantial. Managers have struggled to outperform market cap weighted benchmarks when those benchmarks have been dominated by a few narrow themes. What drives this mentality? Investors give into short term performance pressures, which isn’t a sustainable investment or business strategy, rather than focusing on the long term goal of building wealth. Investors need to have the conviction at times to look different than the benchmark in order to capitalize on opportunities (or inefficiencies) inherent in the market.

Valuation Extremes – Now is Not the Time to Increase Risk Levels

During narrowly focused markets, good active managers tend to stay more rational and balanced, avoiding areas of extreme speculation. Remember, the indices are loaded up with past winners and constructed with no valuation discipline. So in the short run it might be more difficult to keep up because active managers will underweight the overvalued areas of the market. By definition, however, extremes can’t remain at extreme levels – a reversion back towards the mean could create a lot of volatility as the crowding of those narrow factors unwinds. An efficient market is defined as a market full of rational investors who drive prices to fair valuations based on all publicly available information. We believe, however, that investors are not always rational and that markets have periods of inefficiencies that often have nothing to do with fundamental valuations. Active managers exploit and capitalize on these inefficiencies by taking active positions relative to the benchmark on information unique to individual companies. This is certainly the opportunity today. The dominant themes in the market have manifested themselves towards smaller cap companies without any discipline towards price. This growth at any price mentality has driven this group towards extreme valuations. Small cap price to earnings multiples relative to their larger counterparts based on normal earnings are in unprecedented territory. Median price to sales ratios are at historic levels and the bottom quartile of stocks based on size are driving more of the large cap benchmark returns than any other time in history. Given the valuation dislocations and narrow theme, this is the absolute worst time to move towards passive management.

To illustrate this point, it would not have been wise to pile into the S&P 500 index in 1980 during the energy bubble, or the Russell 1000 Growth index in 2000 during the technology bubble, or the Russell 1000 Value index in 2006 during the financial bubble. Admittedly, there isn’t a clear sector bias today, the speculation is more opaque, having more to do with excessive risk taking encouraged by excessive monetary policy. We can observe this, however, in the performance of small cap companies, particularly ones with lower quality financials and greater earnings variability. This is how investors are playing the Fed’s free pass on risk and, more than any other time, these factors have had a greater influence on overall market returns.

Conclusion

Investors hire active managers to outperform their respective benchmarks, with as much or less risk. In order to outperform the benchmark, those managers need to be positioned differently, otherwise investors will end up with expensive managers achieving mediocre returns. The trade off for long term outperformance over market cycles is that during time periods of speculation, good active managers can underperform.

The best managers will have some bad years relative to their benchmarks and will suffer redemptions because of it. In these environments, the debate of passive versus active will become front and center. This is normal and probably cyclical. We also know that when active management is declared “dead” we are close to the end of passive’s dominance over active. Now is the time to re-allocate towards active managers that have proven and understandable disciplines.

James M Francis

Vice President

Montag & Caldwell, LLC

The Russell 1000 Growth Index is an unmanaged index commonly used as a benchmark to measure growth manager performance and characteristics. The Russell 1000 Value Index is an unmanaged index commonly used as a benchmark to measure value manager performance and characteristics. The S&P 500 Index is an unmanaged index commonly used as a benchmark to measure US stock market performance and characteristics. The Russell 2000 Index is an unmanaged index commonly used as a benchmark to measure small cap manager performance and characteristics. An investor cannot invest directly in an index.