At Montag & Caldwell, our Private Client Group is biased towards a less complicated, but often times more effective approach to asset allocation. More recent trends in the market emphasize ineffective and overly diversified solutions that have the potential to not only increase the complexity and reduce the transparency, but may also increase portfolio costs – all of which can significantly reduce a portfolio’s growth potential. At Montag & Caldwell, we believe there is a better way.

Asset allocation design is one of the most significant determinants of portfolio success because it helps to mitigate risk by investing among various financial instruments, but it doesn’t need to be overly complicated or confusing. Our solutions-based approach is premised on our Balanced Strategy, a discrete allocation of high quality growth stocks and high quality bonds, managed within a client specific target range. The Balanced Strategy is most commonly represented by our Institutional Balanced Composite (strategy information available on our website), which has a track record beginning in 1984. The results are at least equal to, and often better than, many of the most sophisticated professionally managed institutional portfolios.

Our approach is a more traditional blend of high quality domestic large and mid cap growth stocks anchored with high quality bonds to mitigate risk and preserve capital. Generally, we don’t believe a discrete allocation to small cap stocks is necessary, particularly because risk adjusted returns favor mid and large market cap stocks over small cap stocks. For example, over rolling five year return periods, compared to small cap stocks, large cap returns have been on average 10% higher with 25% less volatility^. Similarly, mid cap stocks have been on average 21% higher with 15% less volatility^. We also believe that an allocation to international stocks is unnecessary. As of December 31, 2019, our large cap portfolio derived 44% of revenues outside of North America and our mid cap strategy derived 34% of its revenues outside of North America^. Our equity allocations give our Clients access to global markets without taking on the risks associated with direct international exposure. In terms of style, our growth process incorporates a valuation discipline that not only prevents our Clients from overpaying for growth, but opportunistically emphasizes companies that are trading at a discount to their worth. This incorporates the best of growth and value investing styles.

Many portfolios that are over allocated to multiple asset classes have struggled with their diversification goals due to overlapping correlations—meaning that the many asset classes utilized may behave the same way, at the same time – particularly in periods of market stress – when diversification matters most. Additionally, while some alternative investments have historically provided good returns – those allocations require investing with successful managers – who usually limit their exposure to new clients in order to maintain their competitive advantage. Many of these investments are not liquid, and generally have small target allocations, and as a result haven’t been meaningful to portfolio returns – after fees. The only traditional asset class that consistently correlates negatively with equities, meaning the ability to offset equity market declines, is fixed income (bonds), which have been more recently de-emphasized in allocation portfolios.

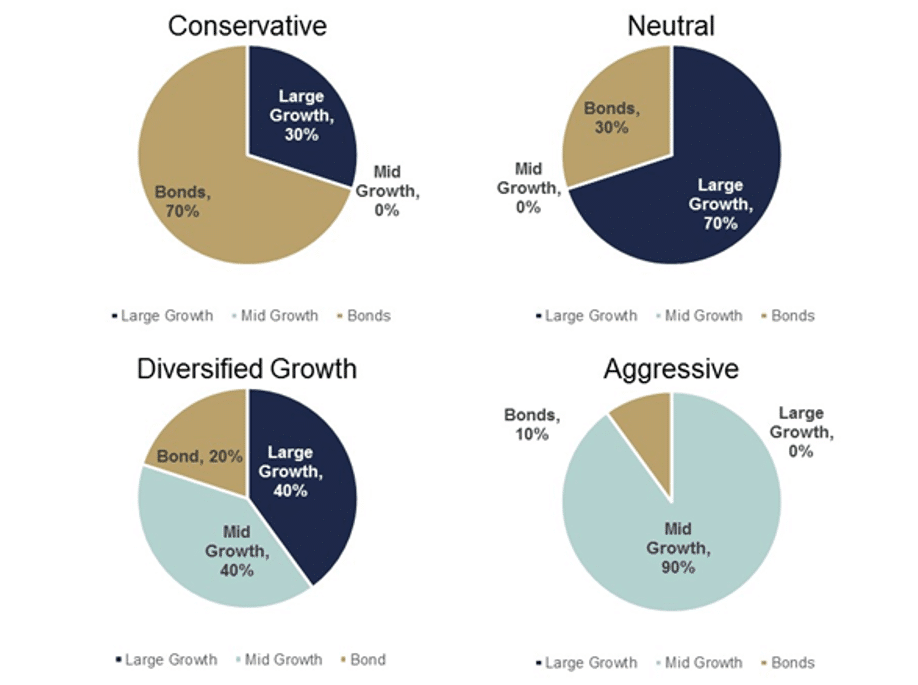

Our allocation approach is individual and customized for each of our Clients. However, to illustrate some of the potential options, we have included the following hypothetical portfolios below, which range from conservative to aggressive allocations. The neutral allocation most closely resembles our Institutional Balanced Composite, which has a track record dating back to 1984. In over one hundred different ten year periods, the Composite’s average annualized return has been 9.03% – after fees and with no negative returns. To illustrate the relative asset preservation potential, this strategy has outperformed the median institutional endowment/foundation portfolio (often described as “smart money”) in each of the past four down market environments (2007-2009, 2011, 2015-2016, and 2018). Importantly, our approach limits the over diversification bias that has penalized returns over the past decade. We feel confident in our ability to deliver a competitive relative return commensurate with your risk and return requirements.

We would love the opportunity to discuss our asset allocation process with you, including guidance and implementation of a customized portfolio solution. To learn more about how Montag & Caldwell can help you, schedule a meeting through our contact us link.

Montag & Caldwell was founded in Atlanta, Georgia in 1945 and has served both private clients and institutional investors for 75 years. While primarily known for managing equity securities, our Firm’s experience also includes fixed income and asset allocation strategies. With an emphasis on managing risk, our investment professionals are as comfortable working with a holistic, solutions-based approach for an individual as we are managing a discrete allocation for an institutional relationship. Montag & Caldwell’s institutional and Private Client Group are both committed to producing superior, proprietary investment solutions with excellent Client service.

Return and standard deviation data is annualized, and for the Composite based on net of fee results. The performance data quoted represents past performance. Past performance is no guarantee of future results.

* Institutional Balanced Composite: The Balanced Strategy referenced is most commonly represented by the Montag & Caldwell Institutional Balanced Composite (“Composite”) which represents a subset of our total Balanced Strategy Client base, specifically those accounts that are fee-paying, discretionary, institutional client, tax-exempt, balanced portfolios with values of $1 million or greater. The Composite was created in June 1994 with construction guidance applied retroactively back to 1984.

The Composite’s average asset allocation can vary over time and is dependent upon the underlying client accounts of which it is composed, and each of those accounts’ individualized asset allocations. The historic long-term average asset allocation of the Composite has been 60% large cap growth / 40% fixed income; however, shorter-term average allocations to large cap growth have been greater. Since November 2018, the Composite has been comprised of only one account with an average allocation of 78% large cap growth / 19% fixed income. Such changes are meaningful in terms of understanding Composite performance as, for example, having a larger allocation to equities during a rising equity market would have positively impacted total return.

Though based on the actual trading of discretionary accounts, Composite performance has inherent limitations. It does not necessarily represent the actual performance of any one client and a client cannot invest directly in the Composite. To the extent there are any material differences between Montag & Caldwell’s management of a Client’s account relative to other similar strategy accounts, Composite performance will no longer be as representative and its illustration value will decrease.

Composite total returns include unrealized and realized gains plus income (including reinvestment of all dividends, interest and other earnings). Fair values of fixed income securities include accrued income. The Composite is size-weighted. Valuations are computed and performance is denominated in U.S. dollars, based on trade-date valuations, and include all transaction costs.

Composite net of fee results were calculated using actual fee deductions. Fees paid by clients may vary depending upon the applicable fee schedule and portfolio size. Montag & Caldwell’s fee schedules are available upon request.

^ Source: National Consulting Firm Database

Standard Deviation: Standard deviation describes the historical volatility of a return series by measuring the variability (or spread) of the returns around the expected normal return over the described period. The wider the spread, the larger the deviation. Source: An independent national consulting firm.

Additional information regarding Montag & Caldwell’s investment strategies may be obtained by contacting us directly at 800-458-5868 or marketingsupport@montag.com or by visiting our website at www.montag.com.

All data presented is as of December 31, 2019