Overview

The Global Tactical Allocation Model (“GTAM”) strategy is a total portfolio solution designed to tactically navigate the best combinations of valuation and growth trends, while providing a well-diversified portfolio with less exposure to market risk. The strategy marries Montag & Caldwell’s traditional active approach emphasizing discipline, consistency, experience and risk management to a diversified portfolio of passive investment vehicles. Diversification is made across a mix of asset classes, sectors and geographies by investing in exchange-traded funds (ETFs) used for their cost efficiencies. Allocations are both deliberate and tactical, and designed to capitalize on current market conditions with minimal overlapping correlations to accentuate the impact of our best ideas.

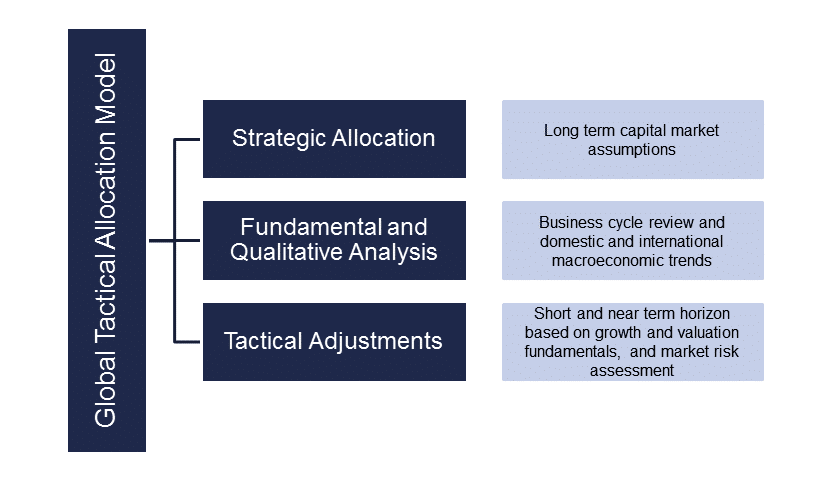

The GTAM Investment Committee constructs Client portfolios using a hybrid approach of a top down macro view that emphasizes business cycle dynamics, coupled with fundamental and qualitative insights from decades of managed money experience.

The team begins with a strategic allocation model that incorporates long-term capital market assumptions for different asset classes and geographies. This allocation is designed to represent a portfolio that compensates the investor for systematic market risks (risks that affect the entire market and cannot be eliminated through diversification). The strategic allocation is represented by the strategy’s benchmark, with the neutral or base case typically considered ~ 60% global equity and ~ 40% fixed income.

The Investment Committee will then make both short- and intermediate-term tactical adjustments relative to the strategic allocation to dynamically capitalize on market opportunities, or to avoid near-term risks. The team monitors a variety of macro-economic data points to assess where we are in the business cycle; and then incorporates changes in monetary policy to our assumptions. A variety of valuation metrics and growth assumptions, as well as technical and sentiment indicators, are considered. By managing the portfolio’s active risk (risk driven by allocation decisions), we believe we can achieve stronger risk adjusted relative performance.

Asset classes become candidates for sale based on deteriorating fundamentals, valuation, or adverse intermediate-term macro-economic trends. The Team will then sell or trim positions to allocate capital to more compelling investment opportunities.

The Client’s risk tolerance, income needs (if any), and growth objective can be taken into consideration for a custom allocation, depending upon Client needs.

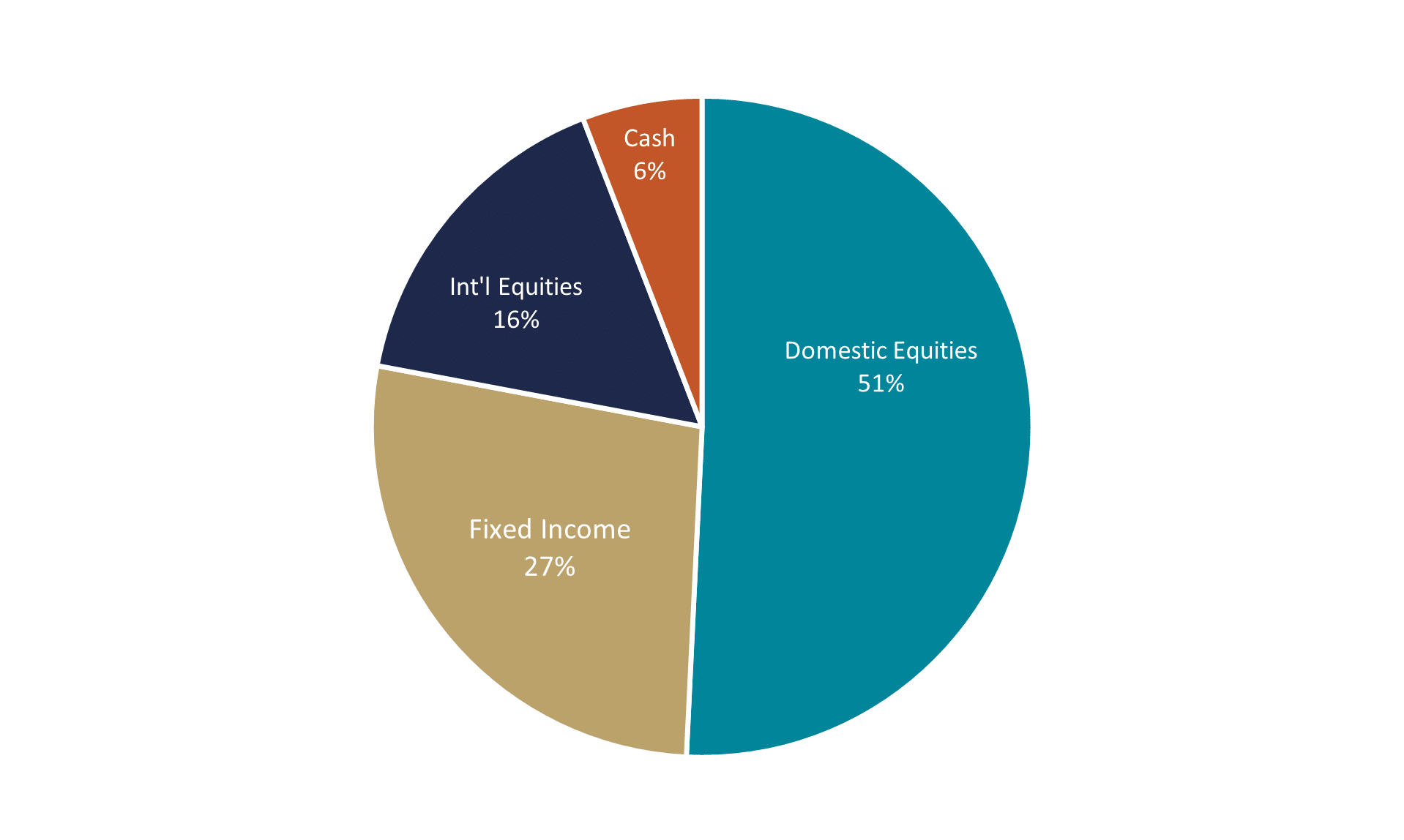

Asset Allocation

March 31, 2025

March 31, 2025

The Portfolio asset allocation is that of the Montag & Caldwell Global Tactical Allocation Representative Account. Please see the disclosures presentation at the bottom of this page for important information that is pertinent to this chart. Source: FactSet.

Recent Publication

4Q24 Global Allocation Summary

3Q24 Global Allocation Summary

Disclosures

This information is provided for illustrative purposes only. It should not be considered investment advice or a recommendation to purchase or sell any specific security or invest in a specific strategy nor used as the sole basis for an investment decision. All investments carry a certain amount of risk. There are no guarantees that the strategy will achieve its investment objective, and loss of value on investments is a possibility. Principal risks associated with this strategy include • Fund of Funds Risk – This strategy primarily invests in externally managed ETFs, and is subject to the risks associated with the respective underlying ETFs. The underlying ETFs incur their own fees and expenses as described in each ETF’s respective prospectus, and the strategy indirectly bears a share of these ETF fees, which are in addition to our management fee. ETF expenses – as represented by the ETF expense ratio – are implied in the ETF’s published daily Net Asset Value (NAV). ETF expense ratios are typically very small, but they do still reduce the ETF’s fund performance. • Asset Allocation and Concentration Risk – We incur risk in making asset allocation decisions, which may include and are not limited to, asset classes, equity styles, and sectors. Different or unrelated (historically uncorrelated) asset classes may exhibit similar price changes in similar directions, which may adversely affect a Client’s account, and may become more severe in times of market upheaval or high volatility. There may also be times when certain segments of the market represented by the underlying ETFs are out of favor and underperform other segments. The strategy will typically hold a small number of ETFs, so a greater portfolio allocation to one or a few of the overall ETFs utilized will result in those respective ETFs having a greater impact on the strategy. • Underlying ETFs Risk – Not all of the strategies underlying each respective ETF may strive to outperform the respective underlying index, meaning that such an ETF, in its efforts to mirror the buy/sell transactions of the underlying index, could buy/sell at disadvantageous times. Each ETF will also periodically turn over its basket of securities in an effort to remain consistent with its stated investment objectives and underlying index, and as it does so, transaction costs on those purchases and sales will be generated. These transaction costs are not captured in the ETF’s expense ratio, but they do affect the ETF’s fund performance. • Value Stock Risk—Value stocks within an ETF may perform differently from the market as a whole and may be undervalued by the market for a long period of time. • Growth Stock Risk – Growth stocks within an ETF may be more sensitive to market movements because their prices tend to reflect investors’ future expectations for earnings growth rather than just current profits. • Market Capitalization Risk – The strategy may invest in equity ETFs representing a range of market capitalization. The stocks of small- and mid-capitalization companies often have greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. • Sector Risk – To the extent the strategy has substantial holdings within a particular sector, the risks associated with that sector increase. • Foreign and Emerging Markets Risk – The strategy may invest in ETFS including or specializing in foreign country and/or foreign company investments which involve additional risks that may result in greater price volatility. Such investments may include emerging markets which are typically less developed and less liquid than markets in developed countries and subject to increased economic, political, and/or regulatory uncertainties. • Interest Rate/Prepayment Risk— In periods of rising interest rates, fixed coupon payments on bonds included in ETFs may become less competitive with the market, causing those underlying bond prices to decline. In periods of decreasing interest rates, bond issuers may pay back bonds earlier than expected or required, and the ETF may not be able to replace those bonds with similar fixed coupon payments without paying higher prices. • Credit Risk—Bond issuers may be unable or unwilling, or may be perceived as unable or unwilling, to make timely interest or principal payments or otherwise honor their obligations. • Liquidity Risk – The strategy, as well as the respective underlying ETF strategies, may not be able to purchase or dispose of investments at favorable times or prices or may have to sell investments at a loss. • Market Risk—Market prices of the ETFs held by the strategy, as well as market prices of the investments underlying each respective ETF, may fall rapidly or unpredictably due to a variety of factors, including changing economic, political, or market conditions, or other factors including war, natural disasters, or public health issues, or in response to events that affect particular industries or companies.