January 11, 2023

Forty-year high inflation and the Federal Reserve’s (“Fed”) aggressive action to combat it was the story of 2022, which was a dreadful one for financial assets. Both the stock and bond markets suffered their worst losses in years while at the same time we witnessed the implosion of the crypto market along with other speculative assets. The market staged a modest bounce-back during the fourth quarter, however, on renewed hopes of a dovish Fed pivot and a soft landing, but otherwise remains mired within a downward trending range.

The U.S. economy has remained resilient this past year in spite of the Fed’s tightening campaign. The strength of household balance sheets, still flush with excess savings left over from the pandemic, along with abundant job and wage growth, have helped to support ongoing growth in consumer spending even as that spending has shifted from discretionary goods to services. However, economic activity does appear to be slowing as we exit 2022 and inflationary pressures are easing, suggesting that the Fed’s actions are beginning to have their intended effect. We certainly see evidence in the housing market where demand has plummeted and building activity is slowing sharply following a doubling of mortgage rates in the past year.

We also are now seeing deflation within commodities and finished goods, a function of mending supply chains and easing demand. Wage growth, however, remains too robust and threatens to become entrenched. Since this underpins labor-intensive services inflation, which accounts for over half of the core personal consumption expenditure (PCE) index that is the Fed’s preferred inflation gauge, cooling the labor market has become job one for the Fed.

Thus, the Fed continues to tighten into slowing growth, increasing the risk of a hard landing. After hiking the Fed Funds rate to 4.25 – 4.5% at its most recent FOMC meeting, an increase of 425 basis points since the start of 2022, the Committee signaled its intention to hike further, potentially raising rates above 5% by year-end 2023. At the same time, the Fed continues to shrink its balance sheet by allowing nearly $100 billion in bonds and mortgage-backed securities to run off each month. The combined effect has lifted the U.S. Proxy Fed Funds rate (a measure that attempts to capture the combined impact of quantitative tightening and higher Fed Funds) to 6.50%, up from below zero just over a year ago, according to the San Francisco Fed. This represents the most aggressive tightening since the early 1980s, and has obvious implications for future growth and profits, especially since monetary policy acts with long and variable lags.

We therefore expect further slowing in 2023 as the lagged effects of tighter monetary policy ripple through the economy. We believe the odds of a recession unfolding at some point this year to be highly probable based on several reliable early recession indicators such as an inverted yield curve, declining leading economic indicators (LEIs), weakening sentiment amongst corporate purchasing managers (PMIs), and deteriorating regional Fed surveys. Consumer spending, in particular, could weaken as a result of declining household net worth, exhaustion of excess savings, and rising job losses.

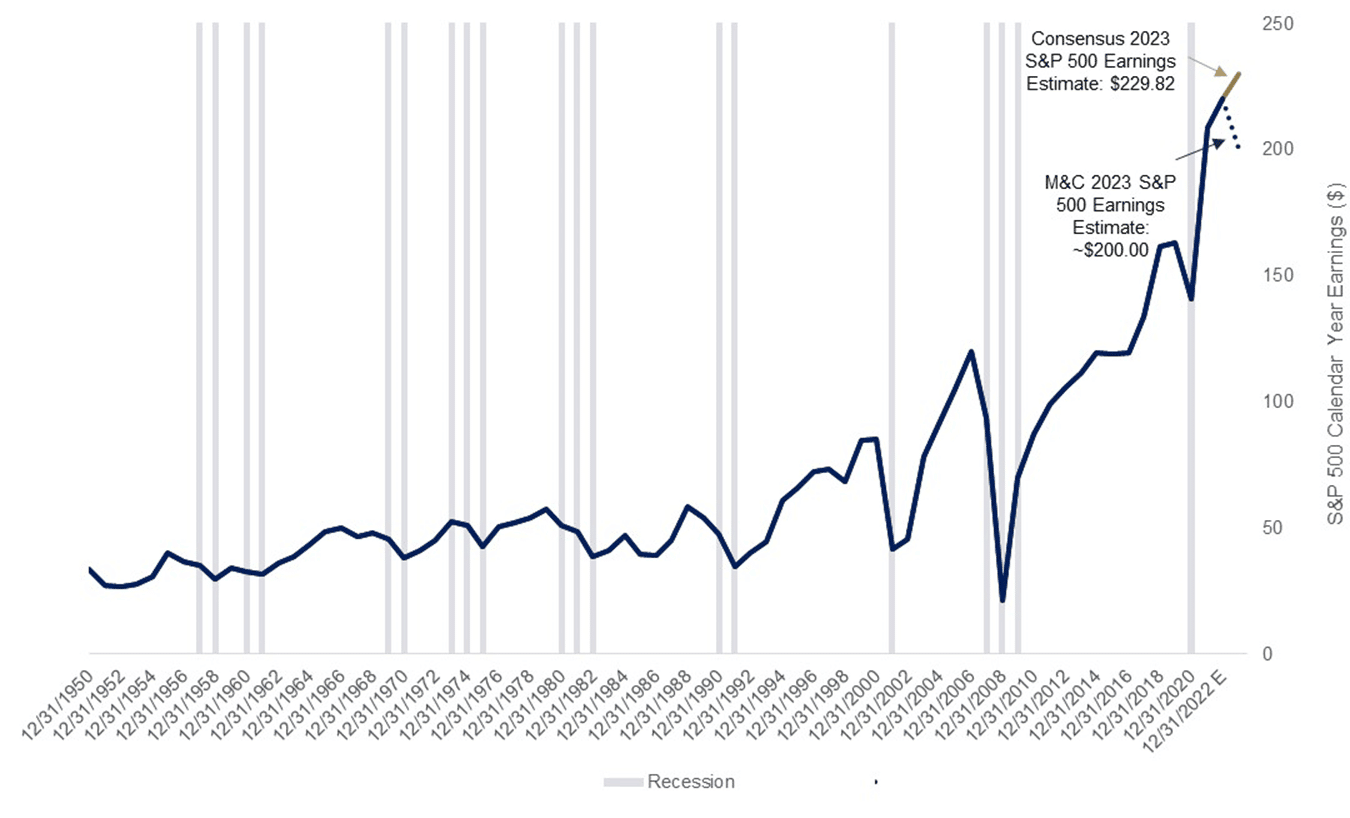

We also expect inflation to continue to moderate over the coming year with core CPI slowing to 3% by year-end 2023, down from close to 6% exiting 2022. Declining corporate profit margins caused by negative operating leverage on weakening revenue growth will likely pressure S&P profits. We believe S&P 500 earnings are likely to fall in 2023, perhaps closer to $200, a decline of 9-10% from 2022’s estimated $220. Consensus Wall Street estimates still call for mid-single digit growth in 2023.

Earnings Revisions Should Favor Quality

Source: FactSet. Data as of January 9, 2023. Gold bar represents 2023 consensus estimates for S&P 500 earnings. The blue dashed line represents M&C’s estimate for 2023 S&P 500 earnings. Recession periods determined by the National Bureau of Economic Research (NBER)

Source: FactSet. Data as of January 9, 2023. Gold bar represents 2023 consensus estimates for S&P 500 earnings. The blue dashed line represents M&C’s estimate for 2023 S&P 500 earnings. Recession periods determined by the National Bureau of Economic Research (NBER)

In our judgment, it is doubtful that the bear market has fully run its course. In fact, it would be historically unique for the market to have bottomed before the recession begins. The initial stage of the current bear market was mostly driven by valuation compression, which we experienced this past year with the forward P/E on the S&P 500 falling from over 21x to under 17x, closer to its long-term historical average. While there may be some additional multiple compression ahead, the next leg will likely be driven more by falling earnings estimates. Amidst disappointing profits, we would expect your portfolio with its heavy concentration of higher quality, durable growth stocks to hold up better than the passive alternatives.

We have exited an unusually low volatility regime. In the years following the Global Financial Crisis, the Fed’s zero interest rate policy and quantitative easing program successfully increased asset prices and depressed market volatility. The indiscriminate increase in asset prices disproportionately benefitted passively managed index funds and ETFs, which tend to be insensitive to price. Higher asset prices led to unprecedented flows into passive vehicles, which further supported higher asset prices, helping to drive equity valuations to extraordinary levels. This was ultimately a momentum play – a self-perpetuating cycle – that left investors with a classic overbuild of passive strategies that are highly concentrated in a handful of names at elevated prices. Passive investors may be particularly vulnerable today because these strategies, by definition, have no inherent mechanisms to manage risk.

We continue to wait patiently for further evidence of investor capitulation on the economic and earnings outlook for this coming year. As economic and earnings recession forecasts become reality, it should catalyze a cathartic volatility spike that presents a more compelling risk/return opportunity for stocks. This phase of market volatility should be even more discriminating towards higher quality fundamentals and disciplines around managing risk (valuation margin of safety, visible relative earnings growth, and portfolio constituent diversification), as the market pays less attention to Fed policy and more towards company specific combinations of valuation and earnings quality. We stand ready to deploy our buying reserves as that happens. In the meantime, we continue to respect the old maxim, “Don’t fight the Fed”.