July 17, 2023

Market Review

As we have watched the recent market advance, we find ourselves pondering two familiar market adages – “Don’t Fight the Fed” and “Don’t Fight the Tape”. The first references the Federal Reserve’s (“Fed”) intended destination for its policy actions. The second alludes to technical price momentum in one direction or the other. At times, the two can work together in concert. For now, however, the two are working in direct conflict. The Fed clearly wants economic growth to slow so that inflation can return to its long-term 2% target, so it continues to tighten monetary policy with that objective in mind. However, the tape is winning for now as the S&P 500 Index continues to power ahead to new 52-week highs, seemingly oblivious to the potential for adverse consequences of the Fed’s actions.

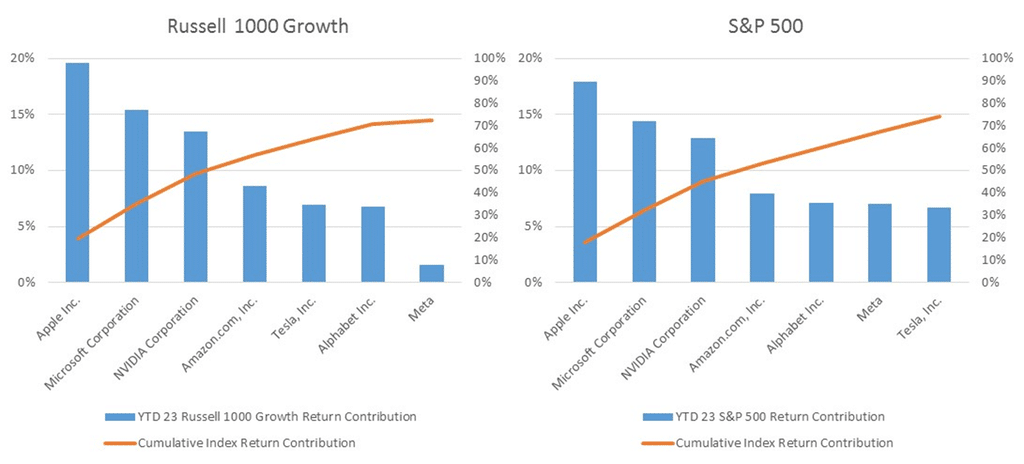

The market rally, however, has been extremely narrow, powered primarily by just a handful of mega-cap technology stocks, referred to as the “Magnificent Seven”. This group includes NVIDIA, Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla, which combined have accounted for almost three-quarters of the Russell 1000 Growth and S&P 500 indices year-to-date total return. Investors have flocked to these stocks for their safe haven status amidst an uncertain economic outlook as well as growing investor enthusiasm for potential beneficiaries of Generative AI. A recent Bernstein analysis (Tech Strategy: The Most Concentrated Market Ever…What Does History Say Happens Next, June 12, 2023) showed that the amount of concentration this year has been historic. The gains have been almost entirely driven by price-to-earnings (P/E) multiple expansion, and subsequent returns for the leaders are likely to be below average as we’ve seen historically following similar periods of concentrated returns. When the market does broaden out to more stocks, we would expect a diversified portfolio of high quality growth companies to benefit.

Source: FactSet. as of June 30, 2023. The Russell 1000 Growth Index is an unmanaged index commonly used as a benchmark to measure growth manager performance and characteristics. The S&P 500 Index is an unmanaged index commonly used as a benchmark to measure U.S. stock market performance and characteristics.

Economic Review

Ongoing strength in the labor market, along with the last remnants of the excess pandemic-era savings, is contributing to resilient consumer spending and postponing the onset of a widely anticipated recession. Despite a growing number of historically-reliable recession signals, the economy thus far has remained stronger for longer, and it is now plausible the start of recession may be pushed out into 2024.

The strong labor market is also contributing to further wage and salary gains along with stubbornly elevated core inflation. Headline inflation readings continue to come down, especially as food and energy prices retreat; however, core inflation is easing much more gradually. Within the core inflation measures there are three primary components: finished goods, housing, and services excluding housing. After declining most of last year as supply chains healed and consumer demand shifted from stuff to experiences, finished goods prices have now begun to bounce higher once again. Housing inflation, which tends to lag more real-time measures of rents, is finally beginning to show signs of retreating, offsetting the recent rebound in finished goods. Meanwhile, labor-intensive core services excluding housing inflation have remained fairly constant at between 4-5%, which is well above the levels consistent with the Fed’s long-term 2% inflation target. This is why the Fed wants to see greater slack in the labor market. With labor supply now rather constrained, hemmed in by demographics and challenges with immigration policy, the only viable way to create that necessary slack in the near term is to cool aggregate demand, which is why we expect the Fed to continue its tightening efforts until it sees more tangible evidence of a softening labor market and cooling core inflation.

The Fed surprised investors by signaling as much at its last FOMC meeting. Its closely followed Summary of Economic Projections indicated a strong likelihood for at least two more +25 basis point rate hikes this year to a level of 5.5-5.75% by year-end, higher than the prior consensus expectation. It wasn’t long ago that the market was anticipating the Fed would be cutting rates this year. The Fed is now pursuing a slower, more deliberate pace of hikes in recognition of the aggressive amount of tightening already exercised in the past year, along with the recent tightening of credit availability by banks in the aftermath of three regional bank failures. Understanding that monetary policy works with “long and variable lags”, the Fed wants to proceed more carefully in order to better observe the impact of this tightening. However, the Fed has clearly communicated it still has work to do to achieve its objectives, and the longer this goes on, the greater the risk to the economy and corporate profits. When the job market does weaken, the Fed is unlikely to be in a position to quickly come to the rescue due to inflation, potentially exacerbating the downturn. This is different than at any time over the past 30 years.

The market’s rise and growing investor complacency seem to suggest more investors are buying into the “immaculate disinflation” story – the market’s latest iteration of “this time is different,” which posits that the Fed will be successful in magically cooling the economy and returning inflation back to its 2% target without triggering a recession. This has never happened when inflation started so high and unemployment so low. As a result, there are two increasingly non-consensus views emerging: either (a) growth and inflation remain stronger for longer, requiring the Fed to take interest rates even higher (above 6% perhaps), or (b) growth and inflation slow materially in the coming months, causing profit margins and earnings to disappoint. Neither outcome would be positive for the market in our view.

Outlook

We continue to hold the view that market risk remains elevated with stock valuations full, earnings estimates at risk, investor sentiment increasingly bullish, and market liquidity set to decline as the Fed resumes Quantitative Tightening (QT) and the Treasury issues over $1 trillion in new debt in coming months following the resolution of the debt ceiling stalemate. We have also entered the typically weak seasonal trading period between May and November. As such, we continue to maintain buying reserves in our clients’ portfolios, eager to deploy at more attractive prices. Despite the upward momentum for the market averages at present, we remain steadfast in our belief that it is ultimately not rewarding to “fight the Fed”.