Growth at a Reasonable Price Orientation

One of the unique characteristics of Montag & Caldwell’s Mid Cap Growth strategy is its growth at a reasonable price orientation. This investment approach (otherwise known as GARP) is often associated with large cap strategies, but we believe it can also be effective in the mid cap space given the asset class volatility (relative to large cap) and the greater opportunity to identify mispriced growth stocks in a less efficient (relative to large cap) asset class.

Investing in growth stocks trading at reasonable prices is a strategy that seeks to combine tenets of both growth and value investing in the stock selection process. GARP investors tend to look for companies that demonstrate consistent, above average earnings growth that are trading at a discount to fair value estimates. The overarching goal is to avoid the extremes of either growth or value investing styles.

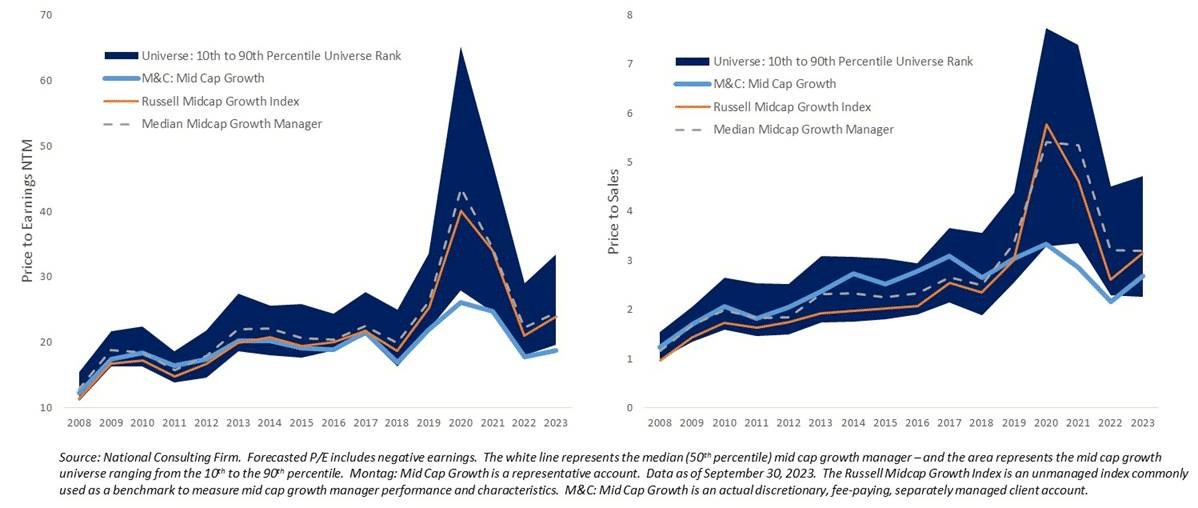

As an illustration, the charts below show the Montag & Caldwell Mid Cap Growth strategy’s next twelve months price to earnings ratio and its price to sales ratio compared to the Russell Midcap Growth index and Callan’s median mid cap growth manager – including the mid cap growth universe peer distribution (10th to 90th percentile). The valuation comparison begins to disconnect in 2019 and peaked in 2020 after the Covid induced bear market spurred a growth at any price run of momentum driven growth stocks – particularly those with exposure to secular growth trends accelerated by the pandemic. This was a period of low interest rates and ample liquidity – an environment that one might rationalize higher equity multiples, particularly if you are willing to subsidize profit potential in the far distant future. However, this approach requires rates remaining low, and liquidity remaining high. It also assumes the traditional price discovery mechanism that many investors rely on to remain irrelevant. This strategy, of course, corrected and sourced much of the market volatility in 2022 as investors were forced to re-price risk in the form of multiple contraction.

Valuation Matters

Valuation Matters

A valuation discipline is simply a way to apply a margin of safety in the investment process. A margin of safety refers to the difference between the intrinsic value of a stock and its market price. Buying stocks at a discount to intrinsic value allows for any potential mispricing errors. Some investors make the mistake of over-estimating (and over paying for) earnings growth, while others under-value stocks with high quality fundamentals that produce a consistent and visible earnings growth profile. While all estimates are subject to error, a valuation discipline forces a level of conservatism towards assumptions that not only help to mitigate risk, but increases the likelihood of meeting or surpassing expectations. Knowing that valuation is imprecise, investing with a margin of safety is a critical risk management tool.

Paying reasonable prices for growth stocks can provide downside market protection, and downside market protection ultimately determines the efficacy of an investment approach. Investment risk and return are largely determined by the acquisition price – so investment success necessarily becomes a function of a good valuation discipline. Valuation disciplines can provide a cushion to any negative surprises and can decrease the chance of fully participating in down markets. It can also be opportunistic, particularly in periods of heightened market volatility – standing ready to invest in new ideas or adding to existing holdings following periods of stock price volatility during which underlying fundamentals do not change – taking advantage of lower stock prices when confidence in a company’s near and medium term earnings fundamentals remains high. Using this approach to minimize risk, or act opportunistically, can provide a more consistent, long-term relative risk-adjusted return profile over market cycles.

A valuation discipline matters as a risk management tool, as a means of identifying opportunistic investments, and as a discipline that provides a rational framework with which to make investment decisions. This approach, over time, and when consistently applied in a repeatable and proven fundamental investment process is a proven approach to building wealth.

About Montag & Caldwell

Montag & Caldwell’s equity selection process utilizes a robust quality framework to assess the required rate of return needed to compensate our Client’s exposure to equity risk. The required rate of return is used as an equity risk premium in the discount rate that determines a company’s fair value estimate. Montag & Caldwell will generally invest anywhere from a 10-15% discount to fair value estimates and will reduce or eliminate when a stock trades at a 20% premium to fair value.

Founded in 1945, Montag & Caldwell is a SEC independent registered investment advisory firm that seeks to provide superior risk-adjusted investment returns through the competent, disciplined, and fundamental analysis of individual securities.