High Quality Mid Cap Growth

One of the factors that sets Montag & Caldwell’s mid cap growth strategy apart is the emphasis on higher quality growth stocks. We believe this bias towards quality, particularly in a more volatile asset class, can reduce portfolio risk without sacrificing strong growth potential.

What is Quality

While there doesn’t appear to be a set of concrete standards that define a company as high quality – there are different approaches and nuances of quality that typically emphasize financially strong companies that have a demonstrated track record of generating strong, predictable, and persistent profits over market cycles.

Similarly, in our work, quality is in part determined by ten variables that comprise a company’s financial score. This score considers the growth history (e.g., earnings growth, plowback, dividend growth); quality of earnings (e.g., free cash flow generation, tax rate); balance sheet strength (e.g., financial strength, long-term debt to capital, total interest coverage); and profitability measures (e.g., net margin, return on equity). In addition to the financial score, we also consider earnings stability, liquidity, and net worth.

We marry this fundamental approach with companies that have distinguished themselves with industry-leading products or services that are supported by some proprietary technology or intellectual property. They typically have strong brands with superior scale and cost advantages that enable them to deliver and defend high profit margins and returns on investment. These companies tend to have proven management teams, strong balance sheets, and robust free cash flow generation that lends confidence in those companies being able to sustain growth and market leadership for a long period of time.

These companies tend to be more reasonably priced with a higher probability of profits today. They typically have stronger, and more assured, near-term earnings growth and stronger balance sheets that should provide support in a more challenging economic environment – allowing them to not only survive, but thrive as they emerge in a stronger competitive position.

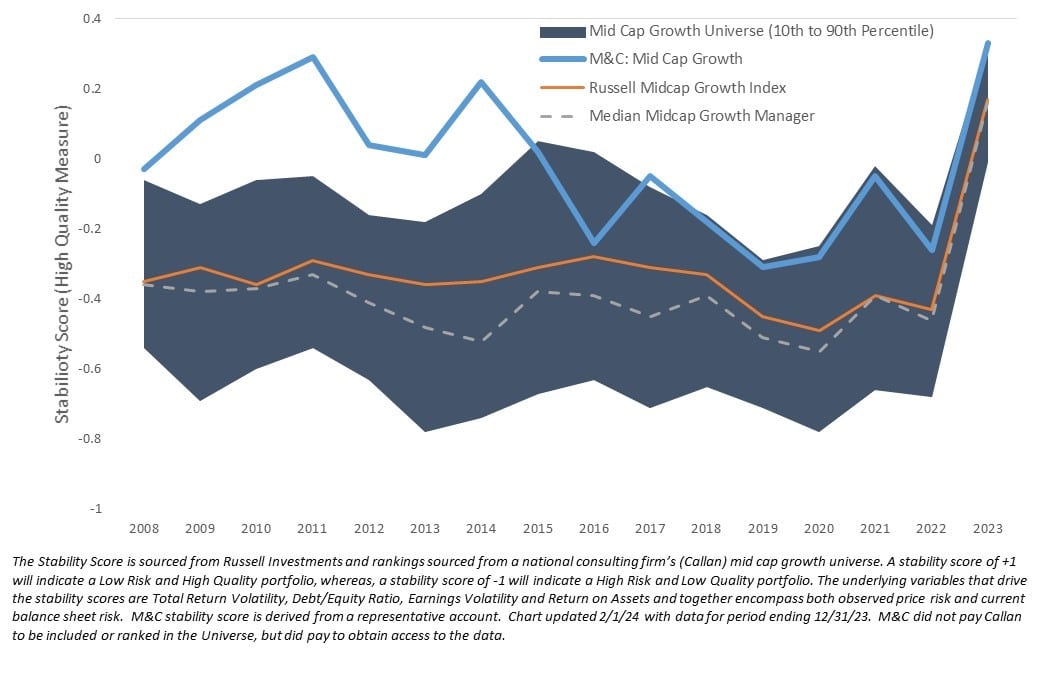

As an illustration, the chart below shows the Montag & Caldwell Mid Cap Growth strategy’s stability score (composite characteristic that indicates portfolio quality) compared to the Russell Midcap Growth index and Callan’s median mid cap growth manager – including the mid cap growth universe peer distribution (10th to 90th percentile). On average, over each calendar year since 2008, our mid cap growth portfolio has demonstrated higher quality stocks than 90% of its peers.

Why Emphasize Quality

Portfolios comprised of companies with strong financials and stable patterns of earnings growth have tended to outperform over full market cycles, with much less risk. Downside protection is a significant driver of higher quality relative returns, accentuated by avoiding lower quality and/or more speculative stocks that tend to over-correct during market downturns or periods of high risk aversion. The quality bias creates more predictability and less volatility, and over cycles, suggests that investors do not necessarily need to take on more risk to earn a greater return.

Rather than paying for growth at any price for companies that may or may not lead to profits in the future – in other words subsidizing short-term losses in the hope of future gains – at Montag & Caldwell, we emphasize higher quality companies that are more reasonably priced and with a higher probability of profits today.

About Montag & Caldwell

Founded in 1945, Montag & Caldwell is a SEC independent registered investment advisory firm that seeks to provide superior risk-adjusted investment returns through the competent, disciplined, and fundamental analysis of individual securities.