Overview

The Investment Policy Group (“IPG”), comprised of all portfolio managers and research analysts, is the catalyst in our decision-making process. Portfolio policy and stock selection are reviewed at IPG meetings held at least twice weekly. Specific decisions regarding purchases and sales, as well as the percent of the portfolio any security is to represent, are based on consensus resulting from these meetings and are implemented across all large cap growth accounts unless there are specific client restrictions. In fully discretionary accounts with no client restrictions, the portfolio managers have no discretion to enact trades that are not approved by the IPG. As the markets do not operate in a vacuum, the IPG also meets twice a month to discuss macroeconomic issues. In these meetings, the IPG makes short-term economic forecasts and systematically reviews long-term economic, social, political and demographic trends having important influences on the financial markets and the companies that we follow. Sector and industry group allocation may be confirmed by this top-down thinking.

The Investment Policy Group (“IPG”), comprised of all portfolio managers and research analysts, is the catalyst in our decision-making process. Portfolio policy and stock selection are reviewed at IPG meetings held at least twice weekly. Specific decisions regarding purchases and sales, as well as the percent of the portfolio any security is to represent, are based on consensus resulting from these meetings and are implemented across all large cap growth accounts unless there are specific client restrictions. In fully discretionary accounts with no client restrictions, the portfolio managers have no discretion to enact trades that are not approved by the IPG. As the markets do not operate in a vacuum, the IPG also meets twice a month to discuss macroeconomic issues. In these meetings, the IPG makes short-term economic forecasts and systematically reviews long-term economic, social, political and demographic trends having important influences on the financial markets and the companies that we follow. Sector and industry group allocation may be confirmed by this top-down thinking.

Large Cap Growth

Montag & Caldwell’s growth equity philosophy emphasizes fundamental valuation techniques which focus on a company’s future earnings and dividend growth rates. The process is primarily bottom up and utilizes a present valuation model in which the current price of the stock is related to the risk adjusted present value of the company’s estimated future earnings stream. Our objective is to identify high quality, large cap growth stocks that are selling at a discount to our estimate of intrinsic value and are expected to exhibit above-median near-term relative earnings strength.

Philosophy and Process

At Montag & Caldwell, we believe that good investment returns are derived from the competent, disciplined, fundamental analysis of individual securities, performed by experienced professionals operating as a team. We are long-term investors focusing on high quality growth opportunities. Our process is primarily bottom-up in which we inter-relate valuation with earnings momentum. We offer a concentrated portfolio of 30-40 issues actively managed by a team comprised of both portfolio managers and analysts. The team is the catalyst in our decision-making. While we recognize the need to diversify a portfolio’s securities and sectors in order to reduce its risk, we believe that, in order to add value, it is also important to have some sector concentration in the portfolio. We are willing to totally exclude a sector from our portfolios if we do not see sufficiently accelerating earnings and/or appropriate valuations. Our growth equity philosophy utilizes a valuation technique which focus’ on a company’s future earnings and dividend growth rates. The process utilizes a present valuation model in which the current price of the stock is related to the risk adjusted present value of the company’s estimated future earnings stream. The identification of appropriate stocks for consideration for our large cap growth product begins with screening a universe of publicly traded U.S. securities for market capitalization of at least $3 billion (although we generally favor at least $5 billion market capitalization for investment consideration and typically purchase those with an $8-10 billion or greater market capitalization), an expected 10% earnings growth rate, and a proprietary quality evaluation. The judgment based on qualitative factors and strong financial characteristics further narrow the universe to a select list. A holding will be reviewed for sale when it reaches our target price, which is normally 120% of the estimated fair value. A significant earnings disappointment will trigger an immediate review of the holding and a decision will be made to buy additional shares or reduce or eliminate the position.

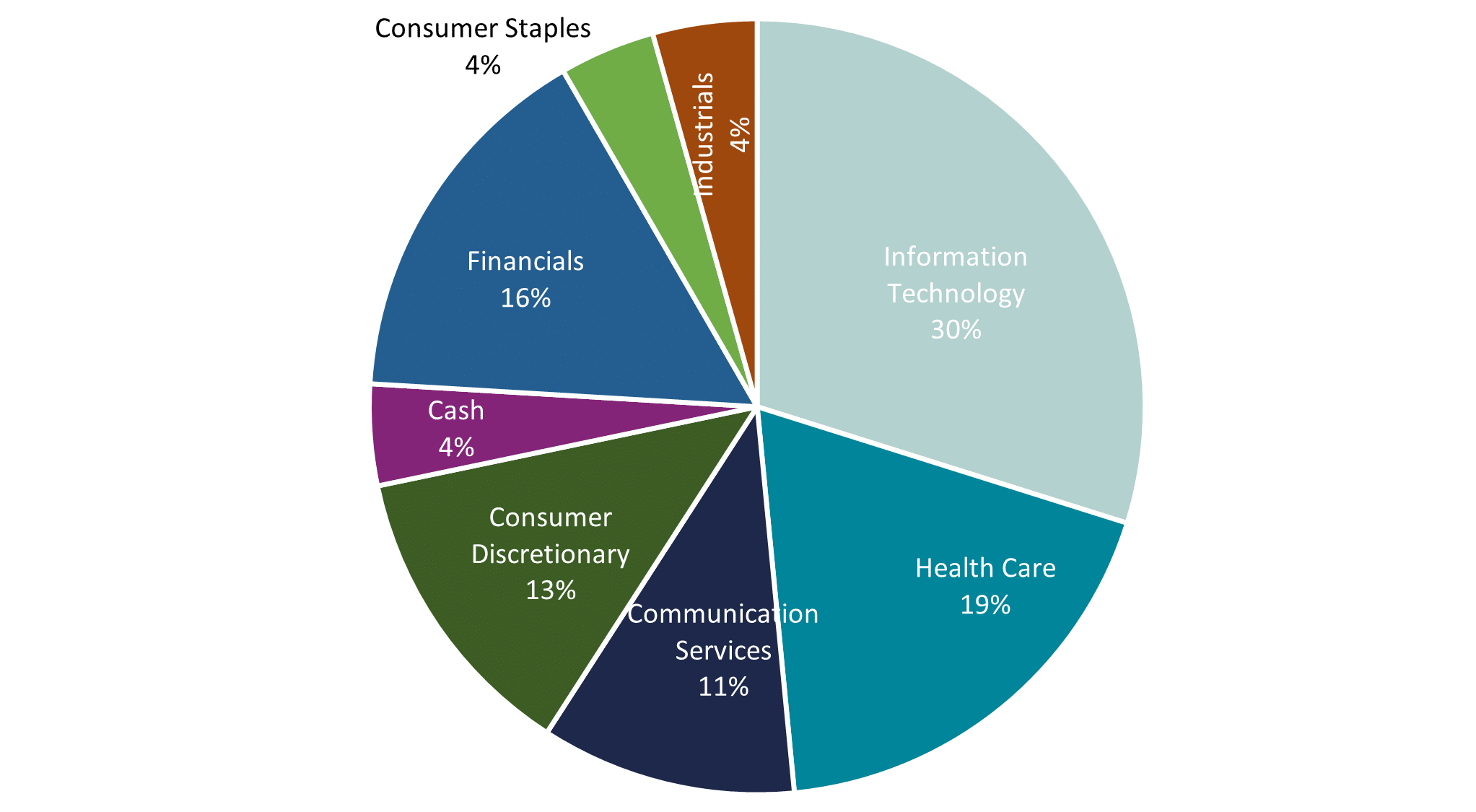

Sector Weights

March 31, 2025

March 31, 2025

Portfolio sector weights are of the Montag & Caldwell Large Cap Growth Representative Account. Please see the disclosures presentation at the bottom of this page for important information that is pertinent to this chart. Source: FactSet

Vehicles

Separate Accounts

Montag & Caldwell, an Advocacy Wealth Company, traces its roots back to 1945. Historically, the Montag & Caldwell brand/business unit has had a significant focus on the institutional separate account market, almost exclusively with our flagship large cap growth strategy. We focused principally on larger clients in the corporate, endowment, foundation, public and Taft-Hartley markets. Our primary means of distribution has been through fee-based consultants or through our direct marketing efforts. M&C’s large cap growth strategy is also available in various Wrap/SMA and UMA programs.

Portfolio Detail

As of March 31, 2025. Portfolio characteristics and top ten holdings are of the Montag & Caldwell Large Cap Growth Representative Account and are a percentage of Equities Only. Please see the disclosures presentation at the bottom of this page for important information that is pertinent to these tables.

Characteristics

Source: FactSet

| Number of Holdings | 30 |

| P/E - Next 12 months | 25.64 |

| 5 Yr. Average ROE | 36.68 |

| LT Debt to Capital | 32.97 |

| Est 3-5 Yr EPS Growth | 15.14 |

| Weighted Avg Market Cap | $710,357MM |

| Median Market Cap | $165,810MM |

| Return on Invested Capital (ROIC) | 23.06 |

| Active Share | 79.95 |

| Turnover (12 months) | 35% |

Top Ten Equity Holdings

Source: Portfolio Accounting System. References to specific portfolio securities are not intended as recommendations of those securities and carry no implications about past or future performance. Information about all recommendations made within the past year is available upon request.

| Amazon.com, Inc. | 5.9 |

| Apple Inc. | 5.3 |

| Visa Inc. Class A | 5.0 |

| Alphabet Inc. Class A | 4.6 |

| Take Two Interactive Software | 4.2 |

| Intuit Inc. | 4.2 |

| Abbott Laboratories | 4.1 |

| Stryker Corporation | 4.1 |

| Monster Beverage Corp. | 3.9 |

| Intercontinental Exchange | 3.9 |

Disclosures

This information is provided for illustrative purposes only. It should not be considered investment advice or a recommendation to purchase or sell any specific security or invest in a specific strategy nor used as the sole basis for an investment decision. All investments carry a certain amount of risk. There are no guarantees that the strategy will achieve its investment objective, and loss of value on investments is a possibility. Principal risks associated with this strategy include: • Growth Stock Risk – These stocks may be more sensitive to market movements because their prices tend to reflect investors’ future expectations for earnings growth rather than just current profits. • Sector Risk – To the extent the strategy has substantial holdings within a particular sector, the risks associated with that sector increase. • Foreign Investment Risk – From time to time, the strategy may invest in U.S. registered ADRs and foreign companies listed on U.S. stock exchanges which involve additional risks that may result in greater price volatility. • Liquidity Risk – The strategy may not be able to purchase or dispose of investments at favorable times or prices or may have to sell investments at a loss. • Market Risk—Market prices of investments held by the strategy may fall rapidly or unpredictably due to a variety of factors, including changing economic, political, or market conditions, or other factors including war, natural disasters, or public health issues, or in response to events that affect particular industries or companies.